FJ Sample Profit & Loss Statement of Taxi Business (Taxis Driven by Owner) 2014-2026 free printable template

Show details

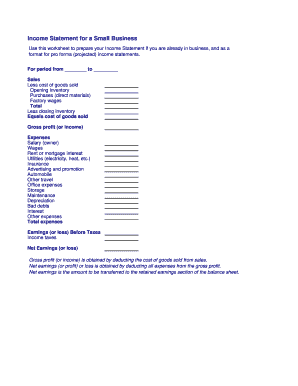

SAMPLE PROFIT & LOSS STATEMENT OF TAXI BUSINESS (TAXI IS DRIVEN BY OWNER) NOTES Each component of financial statement is to be valued at VIP amount. 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11.12. 13. 14. 15.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign uber driver profit and loss statement form

Edit your balance sheet for uber driver form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your profit and loss statement for taxi driver form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing how to fill out fj 09 online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit uber profit and loss statement form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sample taxi business form

How to fill out FJ Sample Profit & Loss Statement of Taxi

01

Open the FJ Sample Profit & Loss Statement template.

02

Fill in the business name and the reporting period at the top of the document.

03

In the 'Revenue' section, enter total fares collected for the period.

04

Include any additional income sources, such as tips or bonuses.

05

Move to the 'Expenses' section and itemize all relevant costs, such as fuel, maintenance, insurance, and licensing fees.

06

Calculate the total expenses by summing all entries in the 'Expenses' section.

07

Subtract total expenses from total revenue to determine net profit or loss.

08

Review all entries for accuracy and make any necessary adjustments.

09

Save the completed document for your records.

Who needs FJ Sample Profit & Loss Statement of Taxi?

01

Taxi drivers and operators who want to track their financial performance.

02

Tax professionals preparing returns for taxi businesses.

03

Business owners seeking to analyze profitability.

04

Investors or lenders evaluating the financial health of a taxi operation.

05

Accountants and bookkeepers managing financial records for taxi services.

Fill

uber profit and loss statement template

: Try Risk Free

People Also Ask about profit and loss statement for truck drivers

What is a P&L statement for self-employed?

A profit and loss (P&L) statement, which may also be called an income statement or income and expense statement, allows a business owner to see in one quick view how much money they are bringing in and spending—and how.

How do I get proof of employment from Uber?

Verifying an Uber Driver If you want to run a verification of employment or income (VOE or VOI) for Uber Drivers/1099 Uber employees, it's recommended to use Truework employment verification services for Uber.

How to fill out a profit and loss statement for self employed?

How to Write a Profit and Loss Statement Step 1 – Track Your Revenue. Step 2 – Determine the Cost of Sales. Step 3 – Figure Out Your Gross Profit. Step 4 – Add Up Your Overhead. Step 5 – Calculate Your Operating Income. Step 6 – Adjust for Other Income and/or Expenses. Step 7 – Net Profit: The Bottom Line.

How to fill out a profit and loss statement for independent contractor?

How to write a profit and loss statement Step 1: Calculate revenue. Step 2: Calculate cost of goods sold. Step 3: Subtract cost of goods sold from revenue to determine gross profit. Step 4: Calculate operating expenses. Step 5: Subtract operating expenses from gross profit to obtain operating profit.

What is a profit and loss statement form?

A profit and loss statement is a financial report that shows how much your business has spent and earned over a specified time. It also shows whether you've made a profit or a loss over that time – hence the name. A profit and loss statement might also be called a P&L or an income statement.

How do I prove my income with Uber eats?

Uber Eats income documentation options The first option is your annual tax summary. You can get this through the driver app by tapping the menu bars, selecting Account, Tax Info, and then Tax Summaries. You can also get this on a desktop browser by logging into your Uber Account, then choosing tax documents.

Does Uber report income to IRS?

Even if you don't receive a 1099, you're still required to report all of your Uber income to the IRS. Since your Uber ridesharing is a business, you will typically use Schedule C, Profit or Loss from Business to deduct your business-related expenses and report your profits for the tax year.

What is a profit and loss statement for self employed people?

A profit and loss (P&L) statement, which may also be called an income statement or income and expense statement, allows a business owner to see in one quick view how much money they are bringing in and spending—and how.

What is an example of a profit and loss?

Suppose a shopkeeper buys a pen at Rs 8 from the market and sells it at Rs 10 at his shop. If the cost is less than the Selling price then it's a profit. If the cost price is more than Selling Price then it's a loss.

How to create a simple profit and loss statement for self employed?

To create a basic P&L manually, take the following steps: Gather necessary information about revenue and expenses (as noted above). List your sales. List your COGS. Subtract COGS (Step 3) from gross revenue (Step 2). List your expenses. Subtract the expenses (Step 5) from your gross profit (Step 4).

What is recorded in a profit and loss statement?

A profit and loss (P&L) statement summarizes the revenues, costs and expenses incurred during a specific period of time. A P&L statement provides information about whether a company can generate profit by increasing revenue, reducing costs, or both.

What is proof of income for Uber driver?

You will likely receive two tax forms from Uber or Lyft. Form 1099-K reports driving income or the amounts received in customer payments for rides provided, and Form 1099-NEC reports any income you earned outside of driving, including incentive payments, referral payments, and earning guarantees.

What do you put on a profit and loss statement?

The P & L statement contains uniform categories of sales and expenses. The categories include net sales, costs of goods sold, gross margin, selling and administrative expense (or operating expense), and net profit. These are categories that you, too, will use when constructing a P & L statement.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my uber driver income statement directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your uber weekly statement as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send taxi driver income and expenses worksheet for eSignature?

When you're ready to share your taxi driver accounts spreadsheet, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I fill out profit and loss statement uber driver on an Android device?

On an Android device, use the pdfFiller mobile app to finish your uber statement download pdf. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is FJ Sample Profit & Loss Statement of Taxi?

The FJ Sample Profit & Loss Statement of Taxi is a financial document that summarizes the revenues, costs, and expenses associated with operating a taxi business over a specific period. It helps in determining the net profit or loss for that period.

Who is required to file FJ Sample Profit & Loss Statement of Taxi?

Taxi operators and owners who are required to report their income for tax purposes, or those who need to assess the financial performance of their business, must file the FJ Sample Profit & Loss Statement of Taxi.

How to fill out FJ Sample Profit & Loss Statement of Taxi?

To fill out the FJ Sample Profit & Loss Statement of Taxi, gather all relevant financial data, including total income, operating expenses, and any additional costs. Enter these values into the designated sections of the template, ensuring accuracy to reflect the true performance of the business.

What is the purpose of FJ Sample Profit & Loss Statement of Taxi?

The purpose of the FJ Sample Profit & Loss Statement of Taxi is to provide a clear overview of the business's financial performance, helping owners and stakeholders make informed decisions, prepare for taxes, and identify areas for improvement.

What information must be reported on FJ Sample Profit & Loss Statement of Taxi?

The information that must be reported on the FJ Sample Profit & Loss Statement of Taxi includes total revenues from fares, operating costs like fuel and maintenance, administrative expenses, any overhead costs, and the net profit or loss after all deductions.

Fill out your FJ Sample Profit Loss Statement of Taxi online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxes Uber Eats is not the form you're looking for?Search for another form here.

Keywords relevant to uber tax summary uk

Related to uber partner payment statement

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.